Real Estate Investment Tips: Get ready to dive into the world of lucrative real estate investments with expert advice and strategies to boost your profits. From passive income to long-term wealth, this guide will equip you with the tools you need to succeed in the real estate market.

Why Invest in Real Estate?

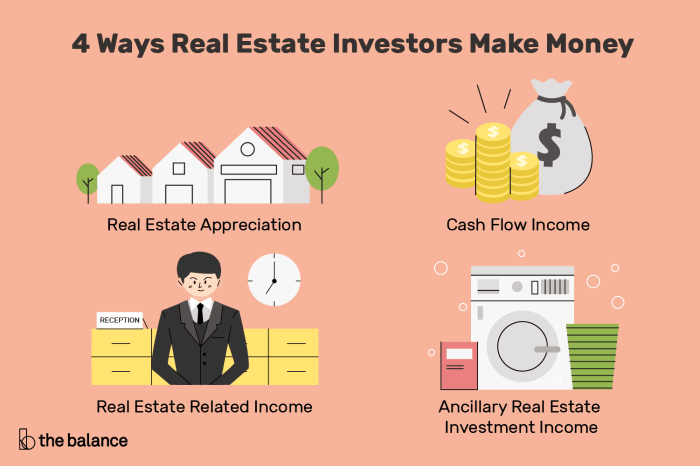

Investing in real estate offers numerous advantages that set it apart from other investment options. Real estate investments have the potential to provide a steady stream of passive income and build long-term wealth through property appreciation and rental income.

Passive Income and Wealth Building

Real estate investments can generate passive income through rental properties. By renting out properties, investors can receive monthly rental payments that can cover mortgage costs and expenses while also providing a profit. Additionally, real estate properties tend to appreciate over time, allowing investors to build equity and wealth in the long term.

Successful Real Estate Investment Stories

One example of a successful real estate investment story is the purchase of rental properties in high-demand areas. By investing in properties that attract tenants, investors can ensure a consistent stream of rental income. Another example is flipping properties for a profit. By purchasing properties below market value, making improvements, and selling at a higher price, investors can realize significant returns on their investment.

Types of Real Estate Investments

Investing in real estate can take many forms, each with its own set of advantages and disadvantages. Let’s explore the different types of real estate investments and what makes them unique.

Residential Real Estate

Residential real estate involves properties like single-family homes, condos, townhouses, and apartments that are used for living purposes. Investing in residential real estate can provide a steady income stream through rental payments. However, it also comes with the challenge of dealing with tenants and property maintenance.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, and warehouses. Investing in commercial real estate can offer higher rental income and longer lease terms compared to residential properties. On the downside, commercial properties may require larger initial investments and can be more sensitive to economic fluctuations.

Industrial Real Estate

Industrial real estate comprises properties like manufacturing facilities, distribution centers, and storage units. Investing in industrial real estate can be lucrative due to the high demand for such properties in certain areas. However, it may require specialized knowledge of the industry and potential environmental risks.

Land Investments

Land investments involve purchasing undeveloped land with the intention of holding it for future development or selling it for a profit. While land investments can offer the potential for significant returns, they also come with the risk of zoning restrictions, environmental issues, and lack of immediate cash flow.

Popular Real Estate Investment Strategies

Some popular real estate investment strategies include rental properties, where investors purchase properties to rent out for passive income, and house flipping, where investors buy properties at a low price, renovate them, and sell them for a profit. Each strategy comes with its own set of risks and rewards, requiring careful planning and research to be successful.

Real Estate Market Trends

Real estate market trends play a crucial role in making informed investment decisions. Keeping a close eye on these trends can help investors navigate the market effectively.

Impact of Interest Rates

Interest rates have a significant impact on the real estate market. When interest rates are low, it becomes more affordable for buyers to borrow money, leading to an increase in demand for properties. On the other hand, high-interest rates can deter potential buyers, resulting in a decrease in housing demand and property prices.

Economic Conditions, Real Estate Investment Tips

Economic conditions, such as job growth, GDP growth, and consumer confidence, also influence the real estate market. A strong economy typically leads to higher demand for housing, while a weak economy may result in decreased demand and lower property values.

Housing Demand

The level of housing demand in a particular area can greatly impact real estate market trends. Factors such as population growth, demographic shifts, and affordability play a key role in determining the demand for housing in a given market. Understanding these factors can help investors identify lucrative investment opportunities.

Tips for Staying Informed

Staying updated on real estate market trends is essential for making informed investment choices. Here are some tips to help you stay informed:

- Follow reputable real estate websites and publications for market updates and analysis.

- Attend real estate seminars, workshops, and networking events to gain insights from industry experts.

- Utilize real estate market data and analytics tools to track market trends and forecast future developments.

- Consult with experienced real estate professionals and advisors to get personalized advice on investment strategies.

Financial Planning for Real Estate Investments: Real Estate Investment Tips

Investing in real estate can be a lucrative venture, but it’s essential to have a solid financial plan in place before diving in. Proper financial planning can help you make informed decisions, mitigate risks, and maximize your returns in the long run.

Creating a Budget for Real Estate Investments

- Evaluate your current financial situation, including income, expenses, assets, and liabilities.

- Set clear investment goals and determine how much you can afford to invest in real estate without compromising your financial stability.

- Consider all the costs associated with real estate investments, such as property taxes, maintenance, insurance, and potential vacancies.

- Allocate funds for unexpected expenses or emergencies to ensure you have a financial buffer.

Strategies for Financing Real Estate Investments

- Explore mortgage options from different lenders to find the best terms and interest rates that suit your financial situation.

- Consider taking out a loan to finance your real estate investment, but make sure you can comfortably repay it based on your projected rental income or resale value.

- Partnering with other investors or real estate professionals can help you pool resources and expertise for larger investment opportunities.

- Utilize creative financing techniques, such as seller financing or lease options, to acquire properties with minimal upfront costs.

Risks and Mitigation Strategies

Investing in real estate can come with its fair share of risks that can potentially impact your returns or even lead to losses. It’s essential to be aware of these risks and have strategies in place to mitigate them effectively.

Market Fluctuations

Market fluctuations can significantly affect the value of your real estate investments. Economic factors, changes in interest rates, or shifts in local market conditions can all contribute to fluctuations. To mitigate this risk, consider diversifying your real estate portfolio across different locations or property types. This can help cushion the impact of market fluctuations on your overall investment.

Property Damage

Property damage, whether due to natural disasters, accidents, or vandalism, can pose a significant risk to real estate investors. One way to mitigate this risk is by investing in insurance coverage for your properties. Having comprehensive insurance can help protect your investments and provide financial support in case of unforeseen events that cause property damage.

Due Diligence

Before making any real estate investment decisions, it’s crucial to conduct thorough due diligence to assess the risks involved. This includes researching the property’s location, market trends, potential rental income, and any existing issues or liabilities. Working with real estate professionals, such as agents, appraisers, or inspectors, can also provide valuable insights and guidance to help you make informed investment choices.