Kicking off with renter’s insurance options, this guide dives into the different types of coverage available, factors influencing costs, and tips for selecting the right policy. Get ready to unlock the secrets of renter’s insurance like never before!

Types of Renter’s Insurance

When it comes to renter’s insurance, there are different options available in the market to suit your needs and budget. Understanding the coverage differences between basic, comprehensive, and specialized policies can help you make an informed decision on what works best for you.

Liability Coverage

Liability coverage is a crucial component of renter’s insurance that protects you in case someone is injured while on your rented property. It helps cover legal fees and medical expenses if you are found responsible for the injury.

Personal Property Coverage, Renter’s insurance options

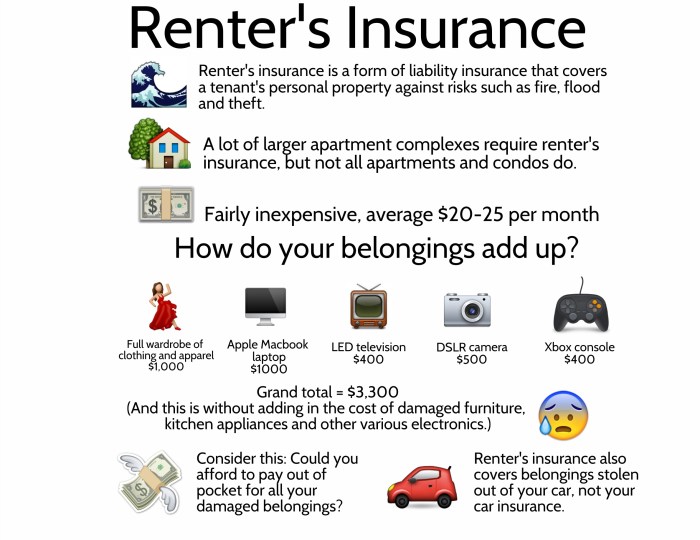

Personal property coverage is designed to protect your belongings in case of theft, damage, or loss due to covered perils like fire or vandalism. It can help replace or repair your items, such as furniture, electronics, and clothing.

Additional Living Expenses Coverage

In the event that your rental becomes uninhabitable due to a covered peril, additional living expenses coverage can help cover the cost of temporary accommodation, meals, and other necessary expenses while your rental is being repaired.

Factors Influencing Insurance Costs

When it comes to renter’s insurance premiums, there are several factors that can influence the cost. Let’s take a look at how location, coverage limits, deductible amounts, and personal factors like credit score can impact your insurance rates.

Location

The location of your rental property plays a significant role in determining your insurance costs. If you live in an area prone to natural disasters, such as hurricanes or wildfires, you can expect to pay higher premiums compared to someone living in a low-risk area.

Coverage Limits

The amount of coverage you choose for your renter’s insurance policy will also affect the cost. Opting for higher coverage limits means you’ll have more protection in case of a loss, but it will also lead to higher premiums.

Deductible Amounts

Your deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums since you’re taking on more of the risk.

Personal Factors

Personal factors like your credit score can also impact your insurance rates. Insurers often use credit-based insurance scores to determine premiums, so maintaining a good credit score can help lower your costs.

Bundling Policies

One way to potentially lower your renter’s insurance costs is by bundling your policies. If you have multiple insurance policies with the same provider, like auto and renter’s insurance, you may be eligible for a discount on your premiums.

Understanding Policy Coverage: Renter’s Insurance Options

When it comes to renter’s insurance, understanding what is covered and what is not can make a huge difference in protecting your assets. Let’s break down the typical coverage options and exclusions you need to know about.

Coverage Breakdown

- Renter’s insurance typically covers personal belongings such as furniture, electronics, clothing, and other items in case of theft, fire, or other covered events.

- Liability protection is another key component, providing coverage in case someone gets injured in your rental property and decides to sue you.

- Additional living expenses coverage kicks in when your rental unit becomes uninhabitable due to a covered event like a fire, providing funds for temporary housing and other expenses.

Common Exclusions

- One common exclusion in renter’s insurance policies is flood damage. If you live in a flood-prone area, you may need to purchase a separate flood insurance policy to protect your belongings.

- Earthquakes are also typically excluded from standard renter’s insurance policies. If you live in an earthquake-prone region, consider adding earthquake insurance to your coverage.

- High-value items such as expensive jewelry, art pieces, or collectibles may not be fully covered by a standard renter’s insurance policy. You may need to add a rider or endorsement to insure these items adequately.

Selecting the Right Coverage

When it comes to selecting the right coverage for renter’s insurance, it’s crucial to assess your individual needs and choose appropriate coverage limits. This will ensure that you are adequately protected in case of any unforeseen events. Follow this step-by-step guide to evaluate your personal property value and determine the coverage amounts that are right for you. Don’t forget to review and update your insurance policy regularly to guarantee that you have sufficient coverage at all times.

Evaluating Personal Property Value

To determine the appropriate coverage limits for your personal property, start by creating an inventory of all your belongings. Take note of the value of each item and consider factors such as depreciation and replacement costs. Use this information to calculate the total value of your personal property and select coverage limits that will fully protect you in case of theft, damage, or loss.

- Make a detailed list of all your belongings, including furniture, electronics, clothing, and personal items.

- Assign a value to each item based on its current market price or replacement cost.

- Consider factors like depreciation and special limits for high-value items such as jewelry or art pieces.

- Calculate the total value of your personal property to determine the coverage amount you need.

Remember to update your personal property inventory regularly to reflect any new purchases or changes in the value of your belongings.

Reviewing and Updating Policies

Regularly reviewing and updating your insurance policies is essential to ensure that you have adequate coverage at all times. Life changes, such as moving to a new place, acquiring new belongings, or renovating your home, can impact your insurance needs. By staying informed and proactive, you can avoid being underinsured and facing financial setbacks in case of an emergency.

- Review your insurance policy annually to assess any changes in your living situation or personal property.

- Update your coverage limits to reflect the current value of your belongings and any new purchases.

- Consider additional coverage options for valuable items or specific risks that may not be included in your standard policy.

- Consult with your insurance provider to discuss any questions or concerns you may have about your coverage.